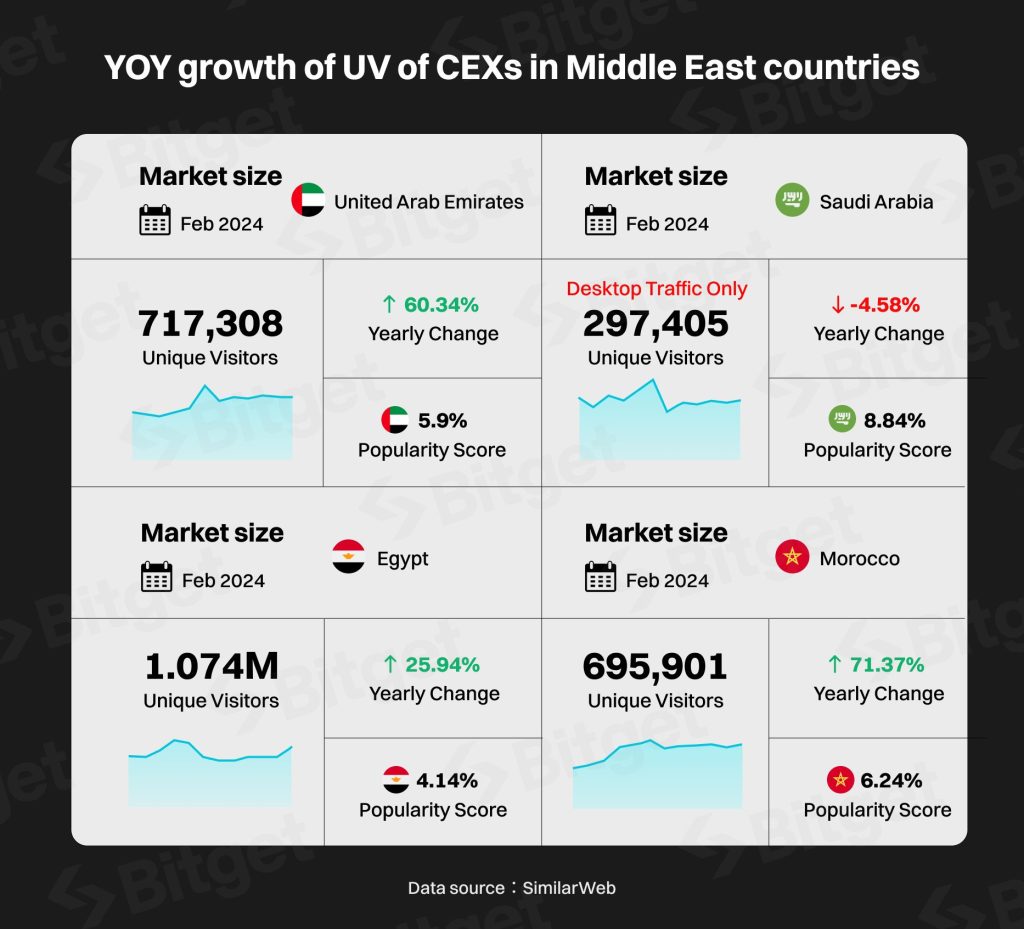

Wallet provider Bitget issued a report at the end of April on the state of cryptocurrency adoption in the Arab region, focusing on Morocco, Egypt, Saudi Arabia, Jordan and the UAE. According to Chainalysis’ Crypto Adoption Index for 2023, these five countries ranked 20th, 35th, 57th, 66th and 78th globally.

According to the report, the number of daily users of centralized exchange platforms in four Arab countries – Morocco, Egypt, Saudi Arabia and the UAE – reached 500,000 users at peak usage during February 2024, led by Egypt with around 160,000 daily users. The four countries witnessed varying rates of growth compared to 2023, with user numbers increasing by 148% in Morocco, and around 70% in Egypt and the UAE, while remaining roughly steady in Saudi Arabia.

The report revealed some variation in the motivations behind cryptocurrency usage in the region. While Saudi users saw crypto as an opportunity to diversify their investment portfolios, Egyptians turned to holding bitcoin to combat inflation affecting the Egyptian pound, in addition to two-thirds of Egyptian crypto users not having bank accounts, and thus using cryptocurrencies as a means of domestic and cross-border remittance.

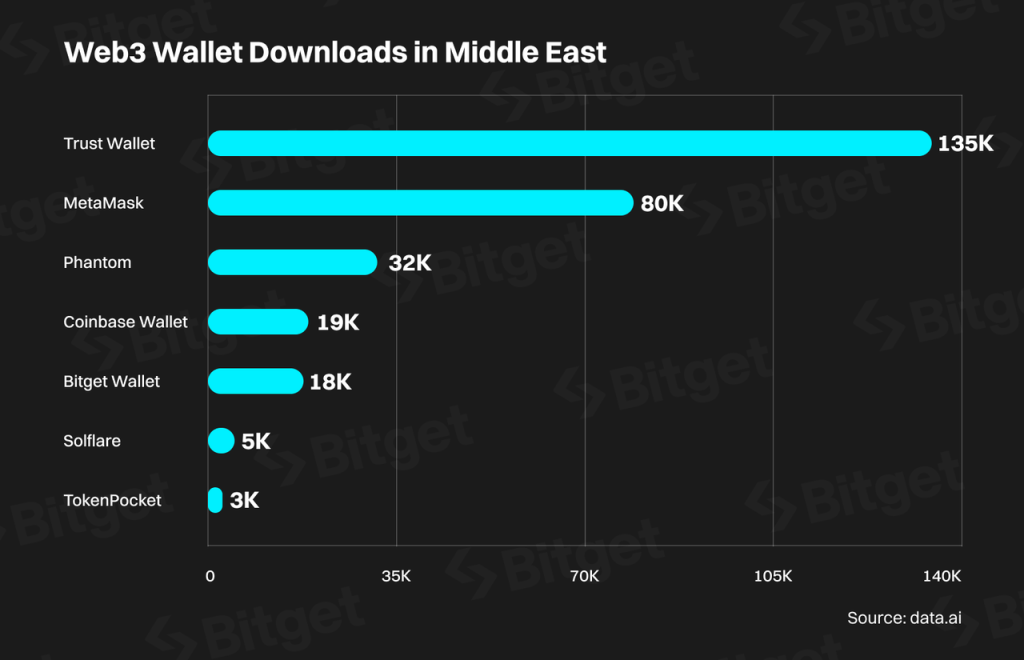

Crypto users in the region tend to favor centralized over decentralized platforms. At the blockchain network level, they prefer using Ethereum, Solana and Binance Smart Chain (BSC), with a focus on meme coins specifically on Solana. On social media, platforms like X (formerly Twitter) and YouTube stand out as hubs for most crypto influencers and enthusiasts. Finally, for wallets, Trust Wallet and Metamask occupy the top two spots respectively, followed by Phantom, Coinbase Wallet and Bitget.

The report also covered the regulatory climate for cryptocurrencies in the five countries. While it classified the UAE as the only country with crypto-friendly regulations, Morocco, Egypt, Saudi Arabia and Jordan were categorized as countries undergoing policy shifts towards the sector, having adopted a prohibitive legislative stance a few years ago, before gradually moving towards regulating cryptocurrency operations and trading.